There are some things we would like you to consider.

Whether you’re just turning 65 or retiring soon, you want to work with an agency who is committed to safeguarding your health coverage for the years to come, rather than working with an agent who is only focused on a one-time assistance of those who are turning 65 this year.

We work for our clients, NOT for the insurance companies. This way, we can make sure you are getting the best possible value for your insurance premium.

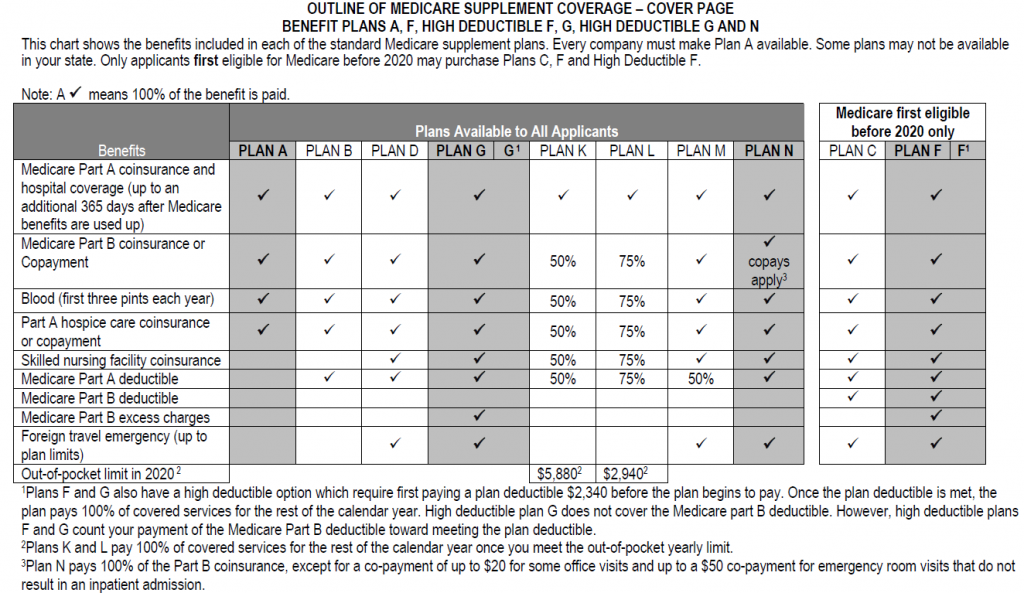

As you review your Medicare & You Guidebook, you will see that all of the Medicare Supplement plans are identical regardless of the insurance company. Each plan pays the bills exactly the same way for the same amount and are all accepted at every Medicare provider the same way.

The only difference? Sometimes, you might be paying $1,200 or more extra per year, depending on which insurance company you chose to get your supplement with.

When you turn 65, it’s important to understand your insurance options. Working with an independent agency that represents multiple insurance carriers will ensure you get the coverage best suited to your needs.

Whether you’re just turning 65 or retiring soon, you want to work with an agency who is committed to safeguarding your health coverage for the years to come, rather than working with an agent who is only focused on a one-time assistance of those who are turning 65 this year.

But what happens when you sign up with a “Turning 65” only Medicare agent? They’re off the next week looking for that next “turning 65” client and they’re not taking care of you – That’s not the customer service you deserve!

This means that our clients like a health care plan with no hidden fees or surprises – like the consistent, monthly premiums that occur with a Medicare Supplement policy. They’re not interested in having a big surprise when they need hospital services nor in seeing increased out-of-pocket costs.

With a Medicare Supplement plan, they can budget their healthcare expenses more effectively and have peace of mind knowing their coverage is reliable. This stability is crucial for managing their financial health and ensuring they can focus on enjoying their retirement years without worrying about unexpected medical bills.

Concerns: | MedicareSupplement | |

| Restrictive Network of doctors and hospitals | NO | |

| Co-Payments to Providers | NO on Plan F or G. Up to $20 on Plan N at Doctor | |

| Up to $6,700 yearly Out of Pocket Costs | NO | |

| Health Plan Decides What Test and Procedures Are Approved For You | NO | |

| Can Your Plan Be Cancelled? | NOCannot be cancelled as long as premiums | |

| Ability to Travel the Country and Use Any Doctor or Hospital | YES | |

| Is Pre-Certification Required for some Treatments? | ||

MD Anderson Cancer MAYO Clinic Included? | YES |

DO NOT CANCEL ANY HEALTH INSURANCE COVERAGE YOU CURRENTLY HAVE OR DECLINE COBRA BENEFITS UNTIL YOU RECEIVE AN APPROVAL LETTER AND INSURANCE POLICY (ALSO KNOWN AS AN INSURANCE CONTRACT OR CERTIFICATE) FROM THE INSURANCE COMPANY YOU SELECTED. MAKE SURE YOU UNDERSTAND AND AGREE WITH THE TERMS OF THE INSURANCE POLICY. PAY SPECIAL ATTENTION TO THE EFFECTIVE DATE, PREMIUM AMOUNT, BENEFITS, LIMITATIONS, AND EXCLUSIONS.

We do not offer every plan available in your area. Currently we represent 10 organizations which offer 30 plan products in your area. Please contact Medicare.gov or 1-800-Medicare, or your local State Health Insurance Program (SHIP) to get information on all your options.

THESE PLANS HAVE ELIGIBILITY REQUIREMENTS, EXCLUSIONS, AND LIMITATIONS. FOR COSTS AND COMPLETE DETAILS (INCLUDING OUTLINES OF COVERAGE), BOOK A CALL WITH A LICENSED INSURANCE AGENT/PRODUCER BY CLICKING THE LINK ABOVE. OR CALL AT THE TOLL-FREE NUMBER SHOWN ON THE CONTACT US PAGE.

© 2023 WadeBenefitServices. All Rights Reserved.

Protected by Security by CleanTalk